It’s not just a good idea, it’s the law!

I first heard about this powerful financial formula in 1992.

I was unemployed back in 1992 for nearly the entire year, so I was very bored and I had a lot of free time and very little money. My savings account was being depleted to supplement the bills my Unemployment Compensation was not covering. I was watching an episode of The 700 Club, a weekday Christian Talk Show. Host Pat Robertson was pushing his self-help tape set LIVING SUCCESSFULLY IN THE ’90s. The cost was rather inexpensive, and I needed all the help I could get in my precarious situation.

The ONLY thing I remember from this course was The Rule of 72, or as Pat Robinson referred to it “The Law of Reciprocity”.

This tool is a very simple formula used to give an close approximation involving the amount of time needed for an investment to double from the compounding of interest. Compound interest is a very powerful financial force which will earn you riches if properly used, or destroy you financially if abused.

A little bit of knowledge goes a long way.

“The thing I have discovered about working with personal finance is that the good news is that it is not rocket science. Personal finance is about 80 percent behavior. It is only about 20 percent head knowledge.” Dave Ramsey–Author and financial expert.

I’m going to use a little bit of very simple math to explain both the Rule of 72 and it’s relation to Compound interest.

What is Compound interest?

Compound interest quite simply defined is interest on interest. It’s the result of reinvesting the interest so that in the next period, the interest is earned on the principal sum plus previously-accumulated interest. I know sounds complicated, but it really isn’t. You need to understand this because it’s how deposits, loans, and especially credit cards work.

Example.

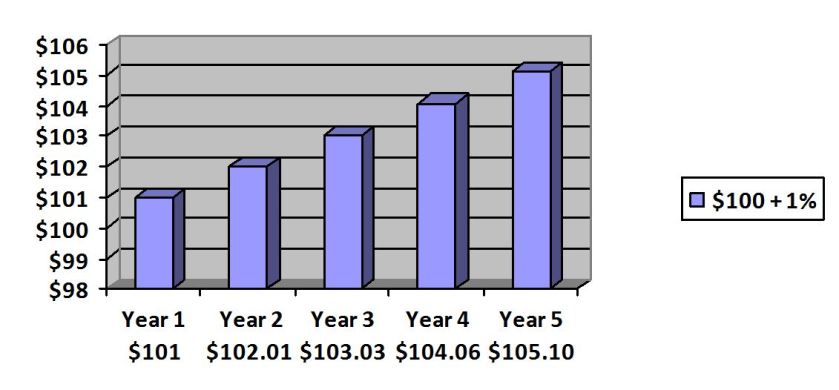

$100 with 1% interest compounded annually for 5 years.

This is assuming you are leaving the money in a savings account by itself, and adding nothing to it.

Now here’s where the Rule of 72 comes into play.

The rule allows you to approximately determine the amount of time needed for the value of your deposit or debt to double! Using the above $100 at 1% example, using the rule of 72, it would take you about 72 years before your untouched $100 became $200.

Here’s how the formula works.

You divide 72 by the interest rate and the result is the number of years needed for doubling.

Let’s say you had $10,000 in a CD (certificate of deposit) at a special 6% rate.

72÷6=12

If you left that CD alone for 12 years, you would have about $20,000 due to the power of compound interest.

Simple huh?

Now that you understand both the Rule of 72 and compound interest, next week I will explain how both relate to credit cards. Don’t miss it! As always I wish you happiness and success!

2 thoughts on “The Rule of 72”